FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 10 novembro 2024

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

LLC Tax Rates and Rules - SmartAsset

Publication 915 (2022), Social Security and Equivalent Railroad

Social Security wage base is $160,200 in 2023, meaning more FICA

2023-2024 Tax Brackets & Federal Income Tax Rates

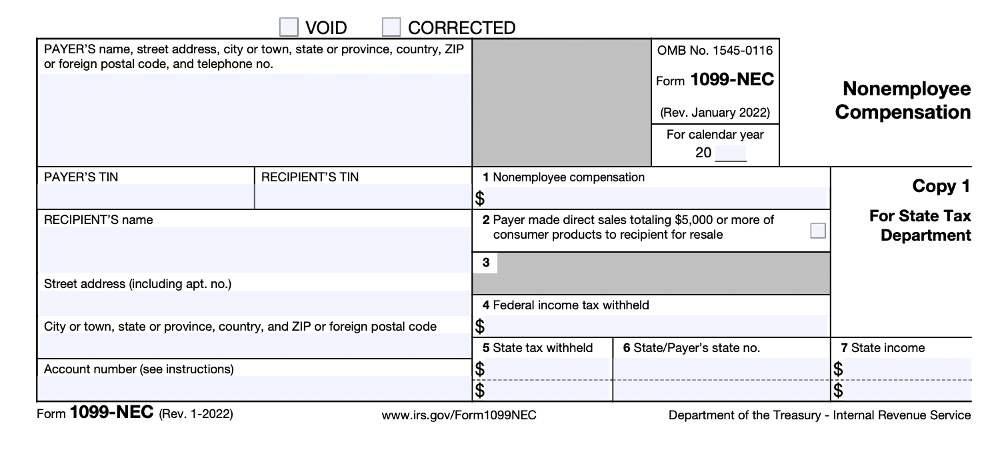

IRS Form 1099 Reporting for Small Businesses

FICA tax rate: Figures and formulas employers need to know

A guide to small business tax brackets in 2022-2023

Tax Reduction Plans for Small Businesses In 2022 - Fully Accountable

IRS Announces 2023 Tax Filing Season Start Date, Deadlines

Maximum Taxable Income Amount For Social Security Tax (FICA)

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes10 novembro 2024

Learn About FICA, Social Security, and Medicare Taxes10 novembro 2024 -

FICA Tax: What It is and How to Calculate It10 novembro 2024

FICA Tax: What It is and How to Calculate It10 novembro 2024 -

What Is FICA Tax: How It Works And Why You Pay10 novembro 2024

What Is FICA Tax: How It Works And Why You Pay10 novembro 2024 -

Social Security and Medicare • Teacher Guide10 novembro 2024

-

FICA Tax Exemption for Nonresident Aliens Explained10 novembro 2024

FICA Tax Exemption for Nonresident Aliens Explained10 novembro 2024 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand10 novembro 2024

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand10 novembro 2024 -

What it means: COVID-19 Deferral of Employee FICA Tax10 novembro 2024

What it means: COVID-19 Deferral of Employee FICA Tax10 novembro 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.10 novembro 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.10 novembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com10 novembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com10 novembro 2024 -

FICA Tax - An Explanation - RMS Accounting10 novembro 2024

FICA Tax - An Explanation - RMS Accounting10 novembro 2024

você pode gostar

-

Super Mario 64 - Play Game Online10 novembro 2024

Super Mario 64 - Play Game Online10 novembro 2024 -

Call of Duty: Modern Warfare: Reflex Review (Wii)10 novembro 2024

Call of Duty: Modern Warfare: Reflex Review (Wii)10 novembro 2024 -

How to Win Cupcake 2048 in 2048 Cupcakes - TechBullion10 novembro 2024

How to Win Cupcake 2048 in 2048 Cupcakes - TechBullion10 novembro 2024 -

As Barbies MAIS ASSUSTADORAS JÁ FEITAS(*NUNCA COMPRE ELAS!*)10 novembro 2024

As Barbies MAIS ASSUSTADORAS JÁ FEITAS(*NUNCA COMPRE ELAS!*)10 novembro 2024 -

Torchic (Pokémon GO) - Best Movesets, Counters, Evolutions and CP10 novembro 2024

Torchic (Pokémon GO) - Best Movesets, Counters, Evolutions and CP10 novembro 2024 -

Haaland impõe lei do ex e Manchester City derrota o Borussia10 novembro 2024

Haaland impõe lei do ex e Manchester City derrota o Borussia10 novembro 2024 -

Pedro Rondon on X: 📰Miami FC anuncia a contratação do atacante Frank Lopez, ex-Rio Grande Valley FC. 🇨🇺Lopez marcou 43 gols e registrou 12 assistências em 140 jogos na USL Championship. / X10 novembro 2024

Pedro Rondon on X: 📰Miami FC anuncia a contratação do atacante Frank Lopez, ex-Rio Grande Valley FC. 🇨🇺Lopez marcou 43 gols e registrou 12 assistências em 140 jogos na USL Championship. / X10 novembro 2024 -

The Chosen Ones - Album by Stratovarius10 novembro 2024

-

File:View of a Hillock at Mastyagiri village.jpg - Wikimedia Commons10 novembro 2024

File:View of a Hillock at Mastyagiri village.jpg - Wikimedia Commons10 novembro 2024 -

Dr. Livesey in One Piece, Dr. Livesey10 novembro 2024

Dr. Livesey in One Piece, Dr. Livesey10 novembro 2024