How to Claim Entrepreneurs Relief in a Members Voluntary Liquidation

Por um escritor misterioso

Last updated 22 dezembro 2024

Suppose you are closing a solvent business through a Members’ Voluntary Liquidation (MVL) process and selling the business’s assets. In that case, you will be liable to pay Capital Gains Tax (CGT) on the profits of all qualifying assets that are sold. However, you may be eligible for tax relief on CGT, which was called

Good news for those planning a Members' Voluntary Liquidation (MVL)

Tax on the winding up of a company

Members Voluntary Liquidation (MVL) Assistance

Entrepreneurs' Relief in a Members Voluntary Liquidation

How Much Does Liquidation Cost and Who Pays? - Business Expert

Who Initiates a Members Voluntary Liquidation?

Advantages Of Liquidating A Company - Oliver Elliot

Pros & Cons of Company Liquidation – What You Need to Know

Members Voluntary Liquidation and Entrepreneurs Relief

How to Claim Entrepreneurs Relief in a Members Voluntary Liquidation

Recomendado para você

-

MVL on the significance of winning the 2021 Sinquefield Cup22 dezembro 2024

-

Hey Reddit, I'm Maxime Vachier-Lagrave (aka MVL), chess grandmaster, 3-time French champion. AMA! : r/chess22 dezembro 2024

Hey Reddit, I'm Maxime Vachier-Lagrave (aka MVL), chess grandmaster, 3-time French champion. AMA! : r/chess22 dezembro 2024 -

Carlsen Falters In Winning Position, Loses To MVL22 dezembro 2024

Carlsen Falters In Winning Position, Loses To MVL22 dezembro 2024 -

MVL price today, MVL to USD live price, marketcap and chart22 dezembro 2024

MVL price today, MVL to USD live price, marketcap and chart22 dezembro 2024 -

40 Mvl Images, Stock Photos, 3D objects, & Vectors22 dezembro 2024

40 Mvl Images, Stock Photos, 3D objects, & Vectors22 dezembro 2024 -

Domestic production of MVL's e-tuktuks to start in December - Khmer Times22 dezembro 2024

Domestic production of MVL's e-tuktuks to start in December - Khmer Times22 dezembro 2024 -

MVL letter logo design in illustration. Vector logo, calligraphy designs for logo, Poster, Invitation, etc. 15030768 Vector Art at Vecteezy22 dezembro 2024

MVL letter logo design in illustration. Vector logo, calligraphy designs for logo, Poster, Invitation, etc. 15030768 Vector Art at Vecteezy22 dezembro 2024 -

MVL Activities (@MVLActivities) / X22 dezembro 2024

MVL Activities (@MVLActivities) / X22 dezembro 2024 -

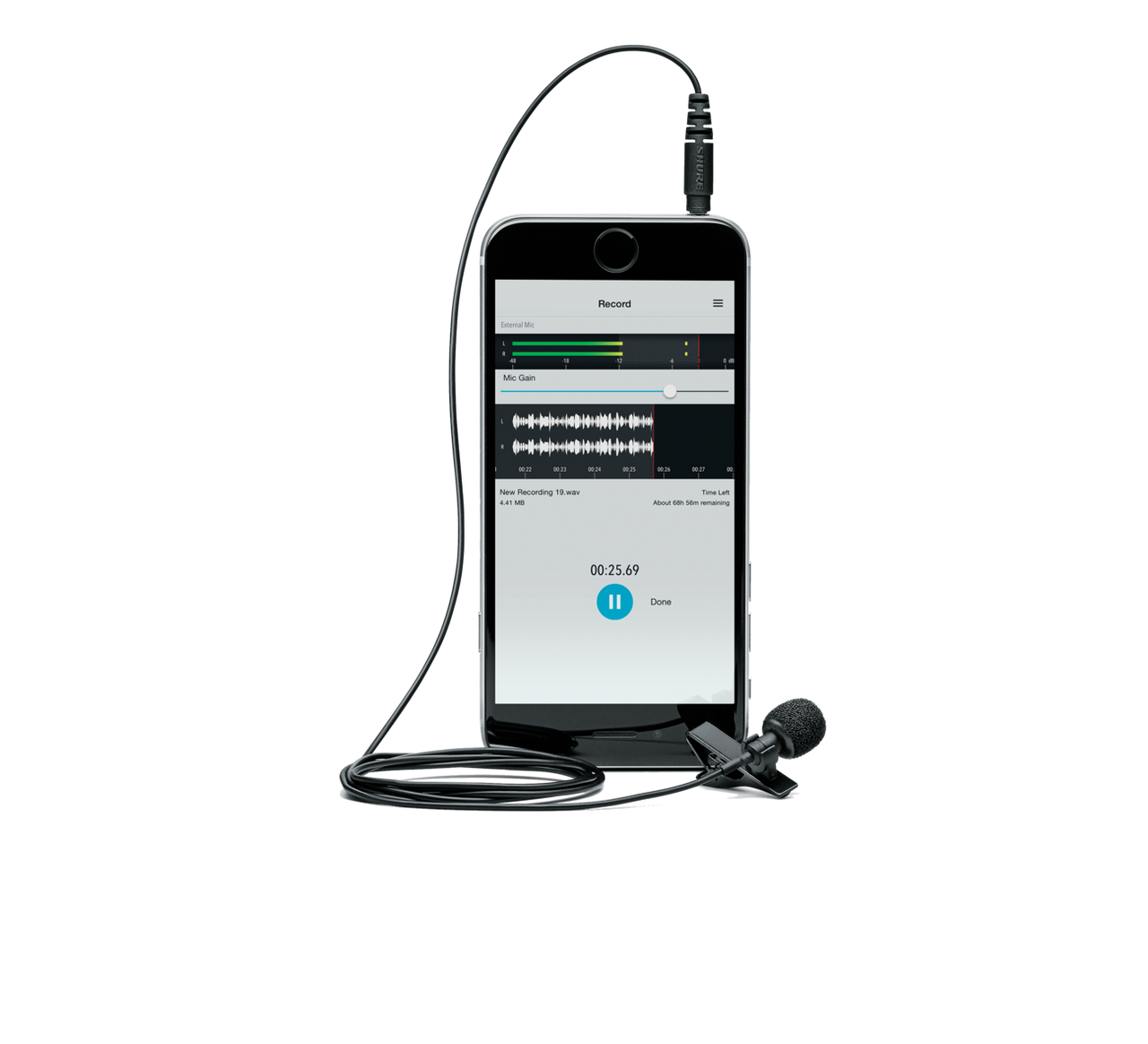

Shure MVL-3.5MM Lavalier Microphone - Sound Productions22 dezembro 2024

Shure MVL-3.5MM Lavalier Microphone - Sound Productions22 dezembro 2024 -

Shure MOTIV MVL Omnidirectional Lavalier Microphone for Smartphones (New Packaging)22 dezembro 2024

Shure MOTIV MVL Omnidirectional Lavalier Microphone for Smartphones (New Packaging)22 dezembro 2024

você pode gostar

-

Cars icon PNG and SVG Vector Free Download22 dezembro 2024

-

Assassin's Creed SGF 2023 Preview - Marooners' Rock22 dezembro 2024

Assassin's Creed SGF 2023 Preview - Marooners' Rock22 dezembro 2024 -

Assistir Digimon Ghost Game Episodio 8 Online22 dezembro 2024

Assistir Digimon Ghost Game Episodio 8 Online22 dezembro 2024 -

LoL Worlds 2023: Knockout stage scores, standings, and results22 dezembro 2024

LoL Worlds 2023: Knockout stage scores, standings, and results22 dezembro 2024 -

Opinions differ: Souls-like Lords of the Fallen received 70 points from critics on Metacritic and Opencritic22 dezembro 2024

Opinions differ: Souls-like Lords of the Fallen received 70 points from critics on Metacritic and Opencritic22 dezembro 2024 -

malboy2006 - Digital Artist22 dezembro 2024

malboy2006 - Digital Artist22 dezembro 2024 -

Koroshi Ai Image by Satou Youko #3384143 - Zerochan Anime Image Board22 dezembro 2024

Koroshi Ai Image by Satou Youko #3384143 - Zerochan Anime Image Board22 dezembro 2024 -

How to Set Parental Controls on the PlayStation 422 dezembro 2024

How to Set Parental Controls on the PlayStation 422 dezembro 2024 -

From Software has 'multiple' new games on the way, Miyazaki22 dezembro 2024

From Software has 'multiple' new games on the way, Miyazaki22 dezembro 2024 -

The Orb is Here: Discover Mørkredd Today with Xbox Game Pass - Xbox Wire22 dezembro 2024

The Orb is Here: Discover Mørkredd Today with Xbox Game Pass - Xbox Wire22 dezembro 2024