DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Last updated 22 dezembro 2024

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

DoorDash Tax Guide: What deductions can drivers take? - Picnic Tax

Doordash Taxes Made Easy, Ultimate Dasher's Guide, Ageras

9 Best Tax Deductions for Doordash Drivers in 2023

Airbnb Tax Deductions Short Term Rental Tax Deductions

Can You Get a Tax Refund with Doordash? How the Income Tax Process

9 Best Tax Deductions for Doordash Drivers in 2023

Your tax refund could be smaller than last year. Here's why

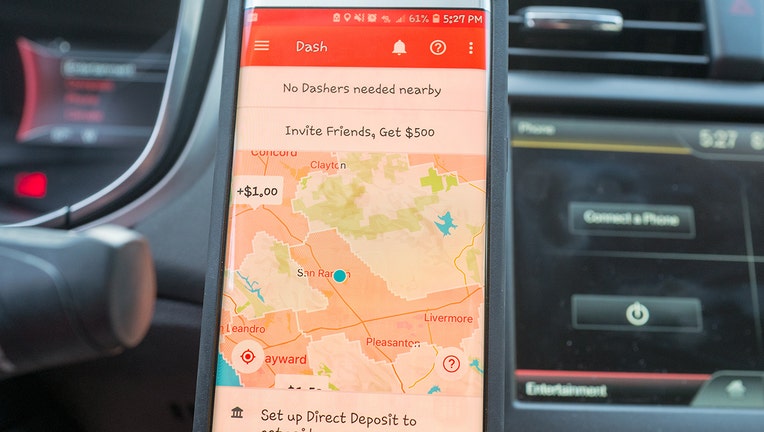

Introduction to DasherDirect

Everlance Mileage Deduction Quiz for DoorDash

How Much Should I Save for Doordash Taxes?

Recomendado para você

-

DoorDash Drive Portal22 dezembro 2024

-

DoorDash Drive Portal22 dezembro 2024

-

DoorDash unveils hourly pay option for delivery drivers22 dezembro 2024

DoorDash unveils hourly pay option for delivery drivers22 dezembro 2024 -

Download DoorDash - Driver on PC with MEmu22 dezembro 2024

Download DoorDash - Driver on PC with MEmu22 dezembro 2024 -

If a DoorDash Driver Hits and Injuries Me, Do I File Claims22 dezembro 2024

If a DoorDash Driver Hits and Injuries Me, Do I File Claims22 dezembro 2024 -

How to Use the Doordash Driver App: Guide & Tutorial For New22 dezembro 2024

How to Use the Doordash Driver App: Guide & Tutorial For New22 dezembro 2024 -

DoorDash Driver Review 2023: 8 Tips for Maximizing Earnings22 dezembro 2024

DoorDash Driver Review 2023: 8 Tips for Maximizing Earnings22 dezembro 2024 -

DoorDash Is Now Letting Restaurants Use Their Own Delivery Drivers22 dezembro 2024

-

DoorDash launches accelerator, grant program for women, minority restaurateurs - Bizwomen22 dezembro 2024

DoorDash launches accelerator, grant program for women, minority restaurateurs - Bizwomen22 dezembro 2024 -

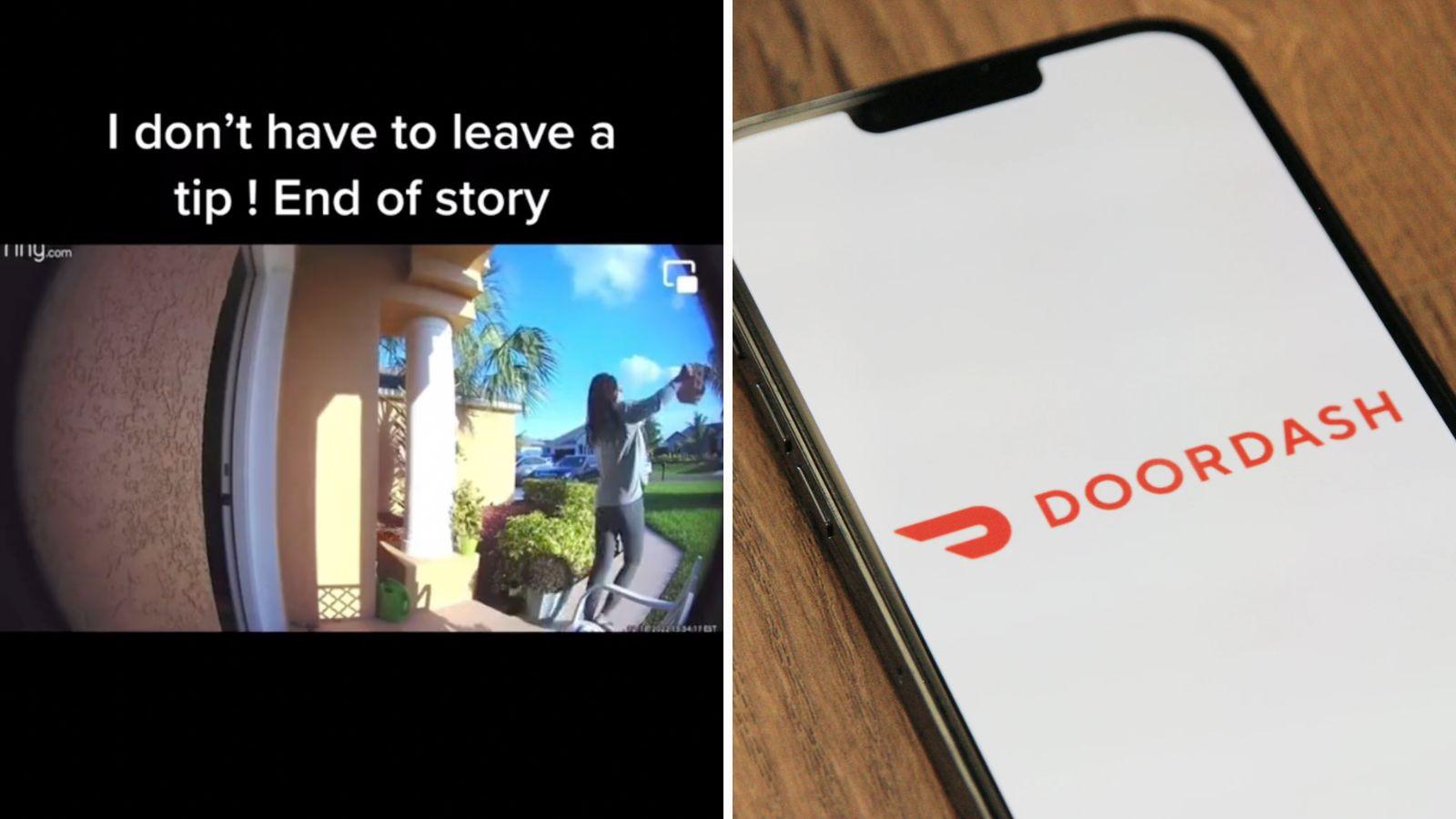

DoorDash driver throws order on the ground after customer doesn't22 dezembro 2024

DoorDash driver throws order on the ground after customer doesn't22 dezembro 2024

você pode gostar

-

Lies of P (@Liesofp) / X22 dezembro 2024

-

IS ABSOL F-TIER NOW?! *Lowest Win Rate* - Pokemon Unite!22 dezembro 2024

IS ABSOL F-TIER NOW?! *Lowest Win Rate* - Pokemon Unite!22 dezembro 2024 -

Moai emoji clipart. Free download transparent .PNG22 dezembro 2024

Moai emoji clipart. Free download transparent .PNG22 dezembro 2024 -

Arsenal FC MINIX Figure 12cm Saka22 dezembro 2024

Arsenal FC MINIX Figure 12cm Saka22 dezembro 2024 -

Camisa Flamengo Pré-Jogo 21/22 Adidas Masculina - Amarelo+Verde22 dezembro 2024

Camisa Flamengo Pré-Jogo 21/22 Adidas Masculina - Amarelo+Verde22 dezembro 2024 -

Caneca Meme Flork Boneco Palito Feliz Páscoa - Preta22 dezembro 2024

Caneca Meme Flork Boneco Palito Feliz Páscoa - Preta22 dezembro 2024 -

Amanda - Novo Bug na SSSGAME rolando, Quero 20% do valor após o valor cair na sua conta, não peço acesso.22 dezembro 2024

-

😮 Weird Slide in the Poolrooms Backrooms : FSRiko : Free Download, Borrow, and Streaming : Internet Archive22 dezembro 2024

😮 Weird Slide in the Poolrooms Backrooms : FSRiko : Free Download, Borrow, and Streaming : Internet Archive22 dezembro 2024 -

Bella Ramsey: 10 produções com a Ellie de The Last of Us22 dezembro 2024

Bella Ramsey: 10 produções com a Ellie de The Last of Us22 dezembro 2024 -

![JoJo All Star Battle Tier List [December 2023]](https://exputer.com/wp-content/uploads/2022/09/JoJo-All-Star-Battle-Tier-List-scaled.jpg) JoJo All Star Battle Tier List [December 2023]22 dezembro 2024

JoJo All Star Battle Tier List [December 2023]22 dezembro 2024