Tax Evasion: Meaning, Definition, and Penalties

Por um escritor misterioso

Last updated 22 dezembro 2024

:max_bytes(150000):strip_icc()/taxevasion.asp_final-8be1e7bf4edc49d3add2ba8af2a2d521.png)

Tax evasion is an illegal practice where a person or entity intentionally does not pay due taxes.

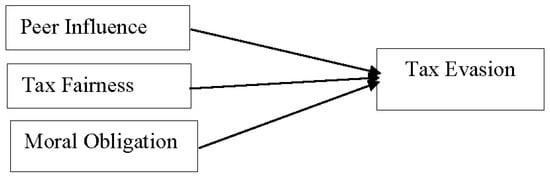

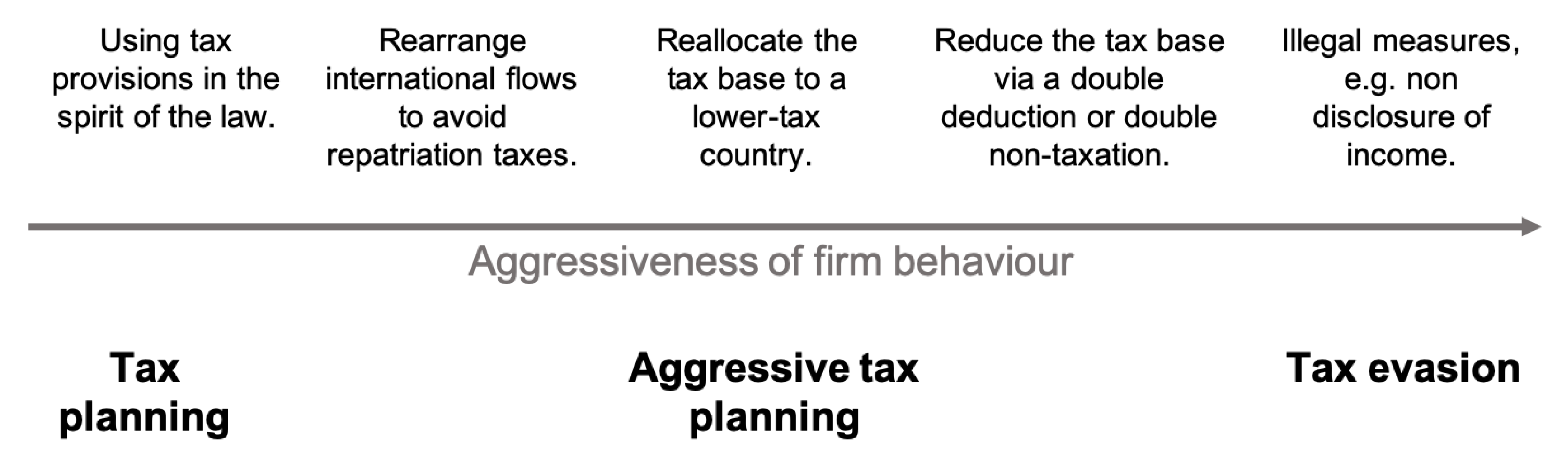

JRFM, Free Full-Text

Differences Between Tax Evasion, Tax Avoidance And Tax Planning

Tax Evasion, An Illegal Act

Some of the best methods to Prevent Tax Evasion - Enterslice

What is Tax Evasion? The Complete Guide

The Case for a Robust Attack on the Tax Gap

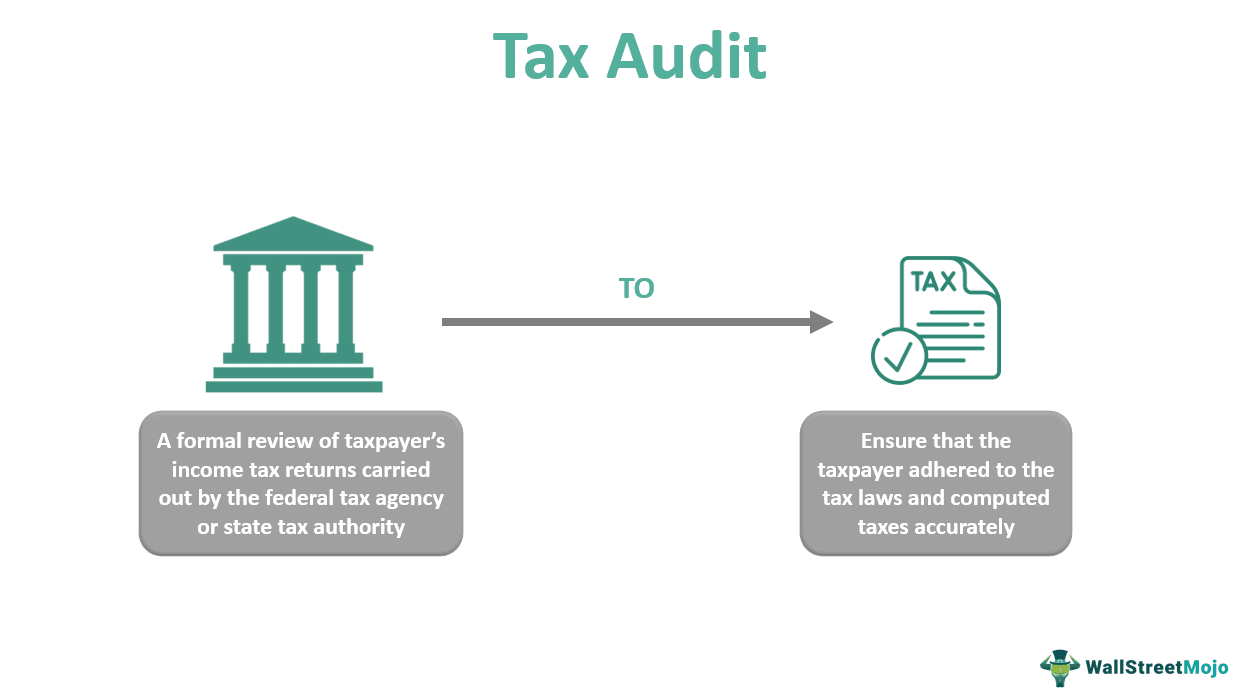

Tax Audit - What Is It, Types, Reasons, Example, Vs Statutory Audit

Federal Tax Fraud Defense Attorney

8 AML Penalties, Fines, and Sanctions + Examples You Should Avoid - Blog

Famous Tax Evasion Cases in the US

A Guide to Tax Evasion Penalties in Hong Kong

What is the Federal Crime of Tax Evasion (26 USC § 7201)

What is the tax gap?

What is Tax Evasion, Common Methods & Penalties for Tax Evasion

Games, Free Full-Text

Recomendado para você

-

Press F to Pay Respects - Where Did It Come From? - Xfire22 dezembro 2024

Press F to Pay Respects - Where Did It Come From? - Xfire22 dezembro 2024 -

Press F to Pay Respects: What Does F Mean Online?22 dezembro 2024

Press F to Pay Respects: What Does F Mean Online?22 dezembro 2024 -

F Ef Noun The Utmost Form Of Respect During An T-Shirt22 dezembro 2024

F Ef Noun The Utmost Form Of Respect During An T-Shirt22 dezembro 2024 -

16 Times Urban Dictionary Defined Words Better Than The Oxford22 dezembro 2024

16 Times Urban Dictionary Defined Words Better Than The Oxford22 dezembro 2024 -

Greek Life Glossary – Greek Life - Montclair State University22 dezembro 2024

Greek Life Glossary – Greek Life - Montclair State University22 dezembro 2024 -

Public Health Administration: Definition, Jobs, Salaries, and More22 dezembro 2024

Public Health Administration: Definition, Jobs, Salaries, and More22 dezembro 2024 -

:max_bytes(150000):strip_icc()/export.asp-final-b6a4a3af93a5427e85efce9c6aba9cab.jpg) What Are Exports? Definition, Benefits, and Examples22 dezembro 2024

What Are Exports? Definition, Benefits, and Examples22 dezembro 2024 -

:max_bytes(150000):strip_icc()/Subordinated_Debt_Final-9aa6c6855b944c68bbc92fafaf12bd9b.png) Subordinated Debt: What It Is, How It Works, Risks22 dezembro 2024

Subordinated Debt: What It Is, How It Works, Risks22 dezembro 2024 -

:max_bytes(150000):strip_icc()/agencytheory-Final-6ad02329f0e24deba6933905f1ea71d9.jpg) Agency Theory: Definition, Examples of Relationships, and Disputes22 dezembro 2024

Agency Theory: Definition, Examples of Relationships, and Disputes22 dezembro 2024 -

LeonButcher on X: Press F to pay respects on #CBLoL / X22 dezembro 2024

LeonButcher on X: Press F to pay respects on #CBLoL / X22 dezembro 2024

você pode gostar

-

NieR: Automata Anime Episode 4 Release Date & Time22 dezembro 2024

NieR: Automata Anime Episode 4 Release Date & Time22 dezembro 2024 -

Os Melhores Artefatos para Cada Personagem22 dezembro 2024

Os Melhores Artefatos para Cada Personagem22 dezembro 2024 -

Talent Hub Log-out and log-in Bug - Talent Hub Bugs - Developer22 dezembro 2024

Talent Hub Log-out and log-in Bug - Talent Hub Bugs - Developer22 dezembro 2024 -

Attack on Titan Levi Shingeki No Kyojin Anime AOT Tshirt T-Shirt22 dezembro 2024

Attack on Titan Levi Shingeki No Kyojin Anime AOT Tshirt T-Shirt22 dezembro 2024 -

Plants vs. Zombies™ Heroes 1.0.11 (arm-v7a) (Android 4.1+) APK Download by ELECTRONIC ARTS - APKMirror22 dezembro 2024

Plants vs. Zombies™ Heroes 1.0.11 (arm-v7a) (Android 4.1+) APK Download by ELECTRONIC ARTS - APKMirror22 dezembro 2024 -

Angels of Death's game/anime bundle debuts on Steam with a huge sale – Destructoid22 dezembro 2024

Angels of Death's game/anime bundle debuts on Steam with a huge sale – Destructoid22 dezembro 2024 -

Anime Fruit Simulator Codes December 2023 - RoCodes22 dezembro 2024

Anime Fruit Simulator Codes December 2023 - RoCodes22 dezembro 2024 -

Entity on X: brb doing research before #RiyadhMasters / X22 dezembro 2024

Entity on X: brb doing research before #RiyadhMasters / X22 dezembro 2024 -

Burger King Brasil - O Anúncio Grelhado do BK voltou! Corre lá no22 dezembro 2024

-

A AVENTURA DO SORVETE SOLITÁRIO CONTINUA! 🍦22 dezembro 2024

A AVENTURA DO SORVETE SOLITÁRIO CONTINUA! 🍦22 dezembro 2024