or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Last updated 31 dezembro 2024

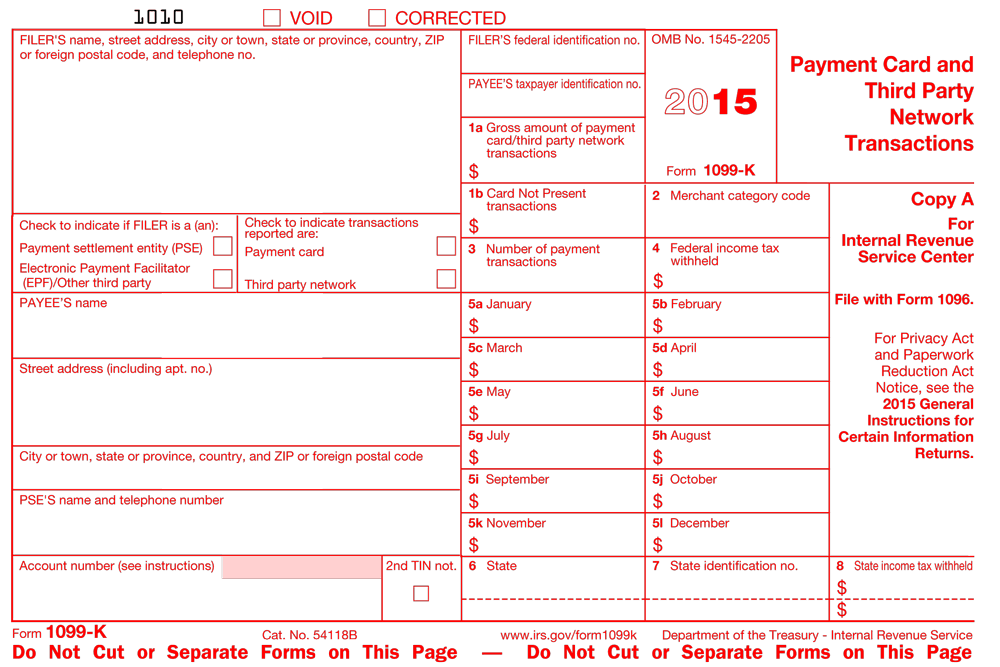

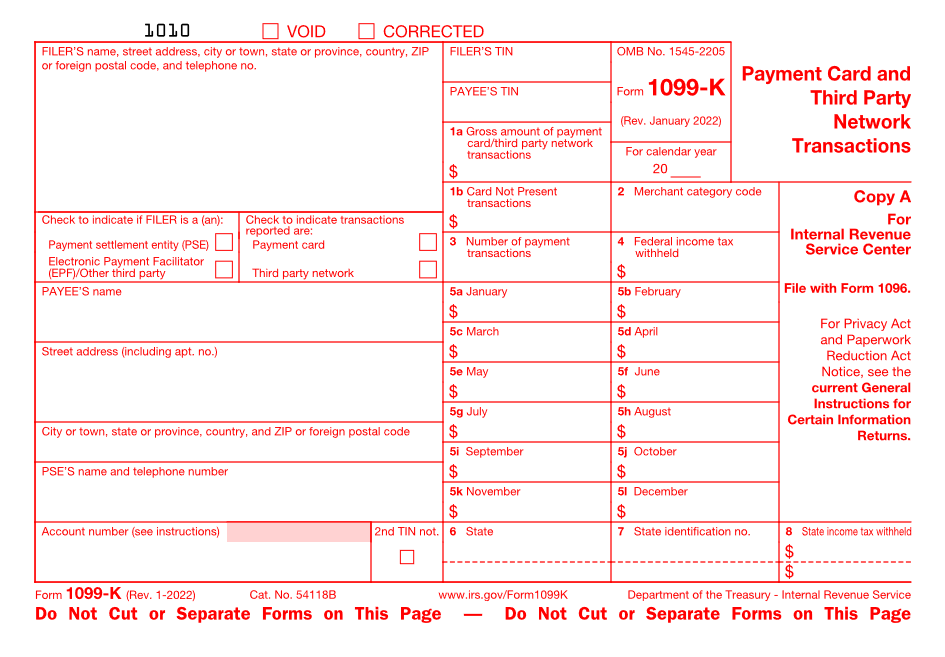

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

Jobber Payments and 1099-K – Jobber Help Center

or Sale of $600 Now Prompt an IRS Form 1099-K

Advice on venmo having to submit sums over $600 to the IRS. : r/personalfinance

new 600 dollar SALES threshold for IRS Reporting , - The Community

What is a 1099-K, How Does It Affect My Business? - VMS

IRS Puts $600 1099-K Threshold Rule on Hold - CPA Practice Advisor

Form 1099-K threshold for 2023

Form 1099-K - IRS Tax Changes and Business Accounts

Petition · Reverse the 1099-k payment threshold for small business back to $20,00 from $600 a year ·

Form 1099-K: Last-Minute IRS Changes & Tax Filing Requirements [Updated for 2024]

Recomendado para você

-

Slides After Disappointing Forecast for Holiday Sales31 dezembro 2024

-

layoffs: 500 jobs cut31 dezembro 2024

layoffs: 500 jobs cut31 dezembro 2024 -

How to Get More Views on : Tips for 202431 dezembro 2024

How to Get More Views on : Tips for 202431 dezembro 2024 -

Announcements - The Community31 dezembro 2024

-

The Community Raises More than $1 Billion for Charities Globally31 dezembro 2024

The Community Raises More than $1 Billion for Charities Globally31 dezembro 2024 -

How Created a Global Community of Doing Good31 dezembro 2024

How Created a Global Community of Doing Good31 dezembro 2024 -

/cdn.vox-cdn.com/uploads/chorus_asset/file/10133015/162794739.jpg.jpg) After 15 years, plans to cut off PayPal as its main payments processor - Vox31 dezembro 2024

After 15 years, plans to cut off PayPal as its main payments processor - Vox31 dezembro 2024 -

Repricer - Beat The Competition to the 'Buy Box31 dezembro 2024

Repricer - Beat The Competition to the 'Buy Box31 dezembro 2024 -

Helping start a conversation with the world - DEPT®31 dezembro 2024

Helping start a conversation with the world - DEPT®31 dezembro 2024 -

Diversity, Equity & Inclusion - Inc.31 dezembro 2024

Diversity, Equity & Inclusion - Inc.31 dezembro 2024

você pode gostar

-

Fifa confirma novo Mundial de Clubes com três times brasileiros; veja formato e classificados - Jogada - Diário do Nordeste31 dezembro 2024

Fifa confirma novo Mundial de Clubes com três times brasileiros; veja formato e classificados - Jogada - Diário do Nordeste31 dezembro 2024 -

King's College London - Chapel, Designed by George Gilbert …31 dezembro 2024

King's College London - Chapel, Designed by George Gilbert …31 dezembro 2024 -

How Do I Add Or Invite Staff To My Organization? - BattleMetrics LLC Knowledge Base31 dezembro 2024

How Do I Add Or Invite Staff To My Organization? - BattleMetrics LLC Knowledge Base31 dezembro 2024 -

Jogo Meu Primeiro Tabuleiro - Pais e Filhos-Bella Biju Arapongas31 dezembro 2024

Jogo Meu Primeiro Tabuleiro - Pais e Filhos-Bella Biju Arapongas31 dezembro 2024 -

BOI BOM – SKALA DESODORANTE ROLL-ON AMÊNDOAS DOCES 60ML31 dezembro 2024

BOI BOM – SKALA DESODORANTE ROLL-ON AMÊNDOAS DOCES 60ML31 dezembro 2024 -

Expanding Brain Meme - Imgflip31 dezembro 2024

Expanding Brain Meme - Imgflip31 dezembro 2024 -

Angry Cat 4K Wallpaper iPhone HD Phone #6881k31 dezembro 2024

Angry Cat 4K Wallpaper iPhone HD Phone #6881k31 dezembro 2024 -

Caderno Brochurão Grande Boruto Volta às Aulas Uma Unidade31 dezembro 2024

-

FORTUNE TIGER NOVA ESTRATÉGIA PARA BANCA BAIXA PAGANDO MUITO NOVA PLATAFORMA DO JOGO DO TIGRINHO31 dezembro 2024

FORTUNE TIGER NOVA ESTRATÉGIA PARA BANCA BAIXA PAGANDO MUITO NOVA PLATAFORMA DO JOGO DO TIGRINHO31 dezembro 2024 -

River City Girls 2 é anunciado para PS4 e PS5; River City Girls original chegará ao PS5 - PSX Brasil31 dezembro 2024

River City Girls 2 é anunciado para PS4 e PS5; River City Girls original chegará ao PS5 - PSX Brasil31 dezembro 2024