Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 10 novembro 2024

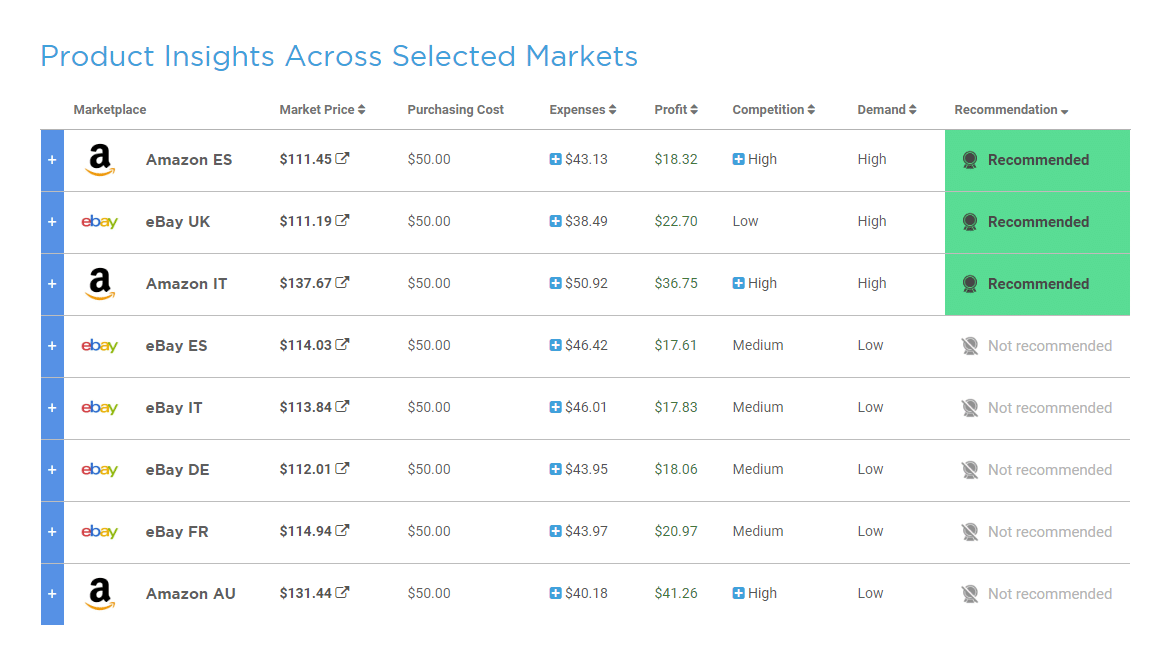

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

Taxation in the United States - Wikipedia

Indirect taxes

NewsWire - Government to increase the VAT percentage up to 18% with effect from January 01, 2024.

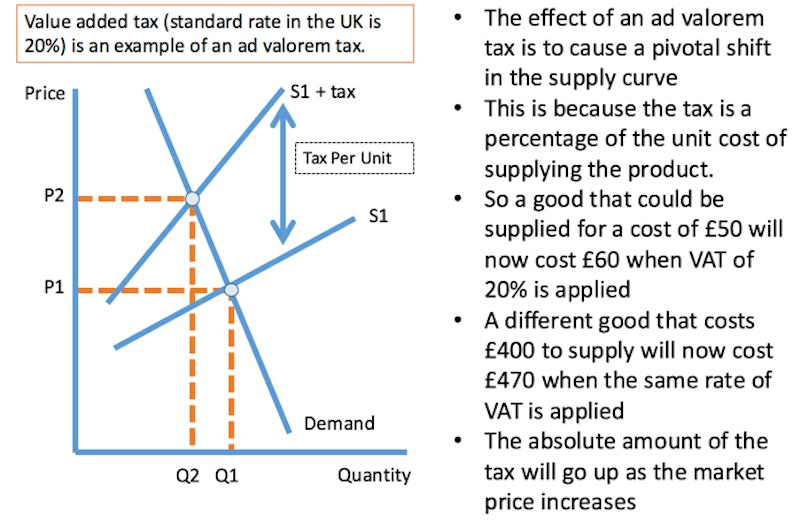

Micro and Macro Effects of Higher VAT (Edexcel 25 Mark Question), Economics

UK VAT changes from 1 January 2021- CaptainBI Blog

Tax guide for American expats in the UK

The rise of high-tax Britain - New Statesman

Instant Download 50th Birthday 1973 British Newspaper Front

Tax Incidence: How the Tax Burden is Shared Between Buyers and Sellers

Recomendado para você

-

Online sales of used goods on up 30% during UK lockdown10 novembro 2024

Online sales of used goods on up 30% during UK lockdown10 novembro 2024 -

Offers Authenticity Guarantee For Luxury Watches In The UK10 novembro 2024

Offers Authenticity Guarantee For Luxury Watches In The UK10 novembro 2024 -

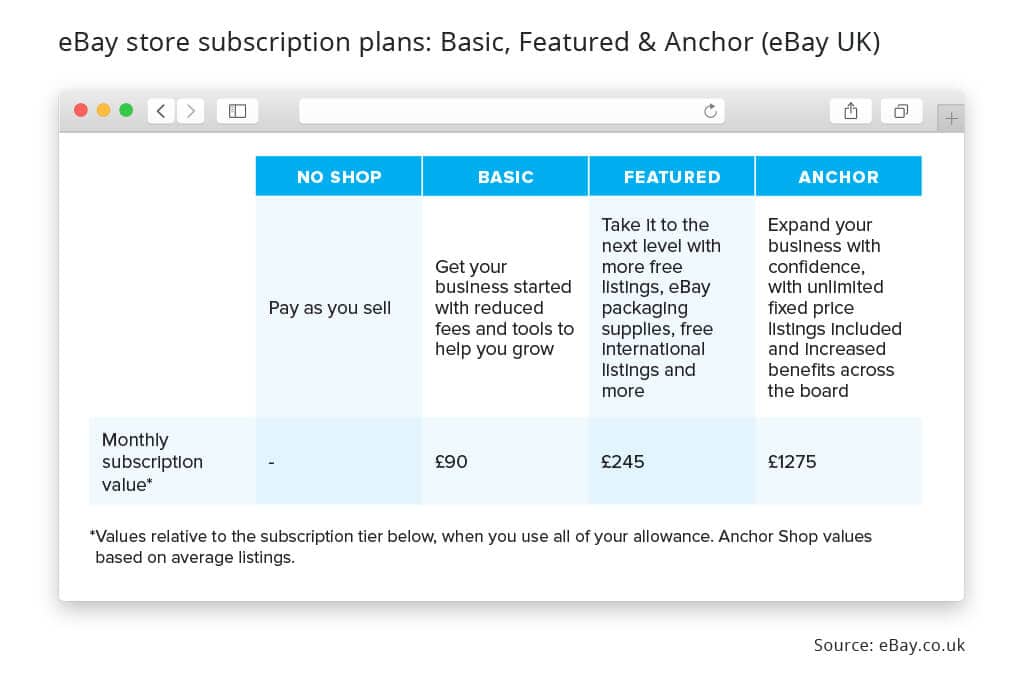

How to Sell on : 17 Selling tips for UK - Full Fees Calculator10 novembro 2024

How to Sell on : 17 Selling tips for UK - Full Fees Calculator10 novembro 2024 -

opens physical pop-up store to reinvent the UK high street - Elite Business Magazine10 novembro 2024

opens physical pop-up store to reinvent the UK high street - Elite Business Magazine10 novembro 2024 -

Start Dropshipping UK with 7 Certified Suppliers in 202310 novembro 2024

Start Dropshipping UK with 7 Certified Suppliers in 202310 novembro 2024 -

UK Seller Tool10 novembro 2024

UK Seller Tool10 novembro 2024 -

The Book: Essential tips for buying and selling on .co.uk10 novembro 2024

The Book: Essential tips for buying and selling on .co.uk10 novembro 2024 -

How to set up an store: key facts & FAQs10 novembro 2024

How to set up an store: key facts & FAQs10 novembro 2024 -

How to Make Money Reselling on in the UK: A Beginner's Guide — Reseller University10 novembro 2024

How to Make Money Reselling on in the UK: A Beginner's Guide — Reseller University10 novembro 2024 -

Online Marketplaces in the UK: and Dominate –10 novembro 2024

Online Marketplaces in the UK: and Dominate –10 novembro 2024

você pode gostar

-

Contents, Tower of God Wiki10 novembro 2024

Contents, Tower of God Wiki10 novembro 2024 -

Run Faster With 3 Simple Speed Training Drills and Exercises10 novembro 2024

Run Faster With 3 Simple Speed Training Drills and Exercises10 novembro 2024 -

Arena e Demave :: Albânia :: Página do Estádio10 novembro 2024

Arena e Demave :: Albânia :: Página do Estádio10 novembro 2024 -

O magnetismo das coisas fúteis10 novembro 2024

O magnetismo das coisas fúteis10 novembro 2024 -

![Sonic Chaos Remake • Mobile gameplay [Part 1]](https://i.ytimg.com/vi/DfCwwm1qi7U/maxresdefault.jpg) Sonic Chaos Remake • Mobile gameplay [Part 1]10 novembro 2024

Sonic Chaos Remake • Mobile gameplay [Part 1]10 novembro 2024 -

Jogo Happy Bubble Bobble Puzzle versão móvel andróide iOS apk10 novembro 2024

Jogo Happy Bubble Bobble Puzzle versão móvel andróide iOS apk10 novembro 2024 -

Os melhores filmes baseados em fatos reais10 novembro 2024

Os melhores filmes baseados em fatos reais10 novembro 2024 -

:strip_icc()/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2020/j/e/fNUMZxQoaYBVveSea2Zw/subway.png) Qual a história de Subway Surfers? Conheça significado, quem criou e mais10 novembro 2024

Qual a história de Subway Surfers? Conheça significado, quem criou e mais10 novembro 2024 -

Open Eye Crying Laughing Emoji Stock Illustration - Download Image Now - Meme, Anthropomorphic Face, Emoticon - iStock10 novembro 2024

Open Eye Crying Laughing Emoji Stock Illustration - Download Image Now - Meme, Anthropomorphic Face, Emoticon - iStock10 novembro 2024 -

Ippo Makunouchi Wallpapers - Wallpaper Cave10 novembro 2024

Ippo Makunouchi Wallpapers - Wallpaper Cave10 novembro 2024