What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?

Por um escritor misterioso

Last updated 22 dezembro 2024

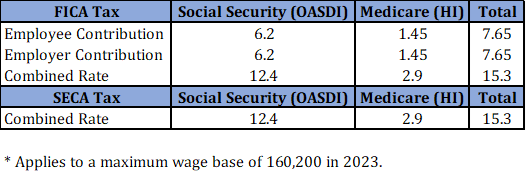

In addition to funding Social Security benefits and Medicare health insurance, the FICA tax (Federal Insurance Contribution Act) is a payroll tax that is split between employees and employers. In addition to 7.65% (6.2% for Social Security and 1.45% for Medicare), they both contribute 15.3% to FICA, which is a combined contribution of 15.3%. Employees can earn up to $137,700 in 2020. Medicare does not have a wage limit.

2022-2023 FICA Percentages, Max Taxable Wages and Max Tax

Social Security Financing: From FICA to the Trust Funds - AAF

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

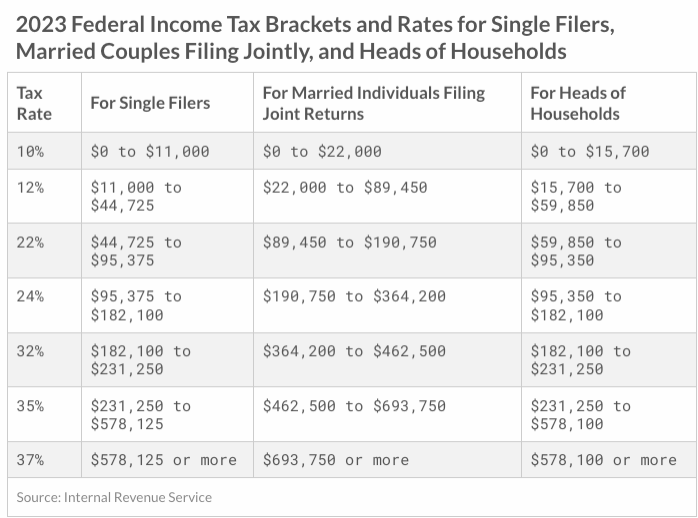

2023 Tax Brackets, Social Security Benefits Increase, and Other

Pennsylvania Hourly Paycheck Calculator, PA 2023 Tax Rates

What is FICA Tax? - The TurboTax Blog

What Is FICA Tax: How It Works And Why You Pay

State Wage and Tax Guides Payroll Tax Rates & Limits By State

FICA Tax: Understanding Social Security and Medicare Taxes

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck22 dezembro 2024

What is Fica Tax?, What is Fica on My Paycheck22 dezembro 2024 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest22 dezembro 2024

Important 2020 Federal Tax Deadlines for Small Businesses - Workest22 dezembro 2024 -

2023 FICA Tax Limits and Rates (How it Affects You)22 dezembro 2024

2023 FICA Tax Limits and Rates (How it Affects You)22 dezembro 2024 -

FICA Tax Exemption for Nonresident Aliens Explained22 dezembro 2024

FICA Tax Exemption for Nonresident Aliens Explained22 dezembro 2024 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers22 dezembro 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers22 dezembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know22 dezembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know22 dezembro 2024 -

2021 FICA Tax Rates22 dezembro 2024

-

How Do I Get a FICA Tax Refund for F1 Students?22 dezembro 2024

How Do I Get a FICA Tax Refund for F1 Students?22 dezembro 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.22 dezembro 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.22 dezembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com22 dezembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com22 dezembro 2024

você pode gostar

-

Wei Wuxian, Grandmaster of Demonic Cultivation Wiki22 dezembro 2024

Wei Wuxian, Grandmaster of Demonic Cultivation Wiki22 dezembro 2024 -

Kit Jogo Da Vida + Detetive Jogos De Tabuleiro Estrela no Shoptime22 dezembro 2024

Kit Jogo Da Vida + Detetive Jogos De Tabuleiro Estrela no Shoptime22 dezembro 2024 -

O Assassino subverte expectativas como um “anti-John Wick22 dezembro 2024

O Assassino subverte expectativas como um “anti-John Wick22 dezembro 2024 -

Hot wheels Mattel Micro machine Monster Jam Truck Hooligan Delivery Van rare Lot22 dezembro 2024

Hot wheels Mattel Micro machine Monster Jam Truck Hooligan Delivery Van rare Lot22 dezembro 2024 -

Baixar Wrassling 1.4 Android - Download APK Grátis22 dezembro 2024

Baixar Wrassling 1.4 Android - Download APK Grátis22 dezembro 2024 -

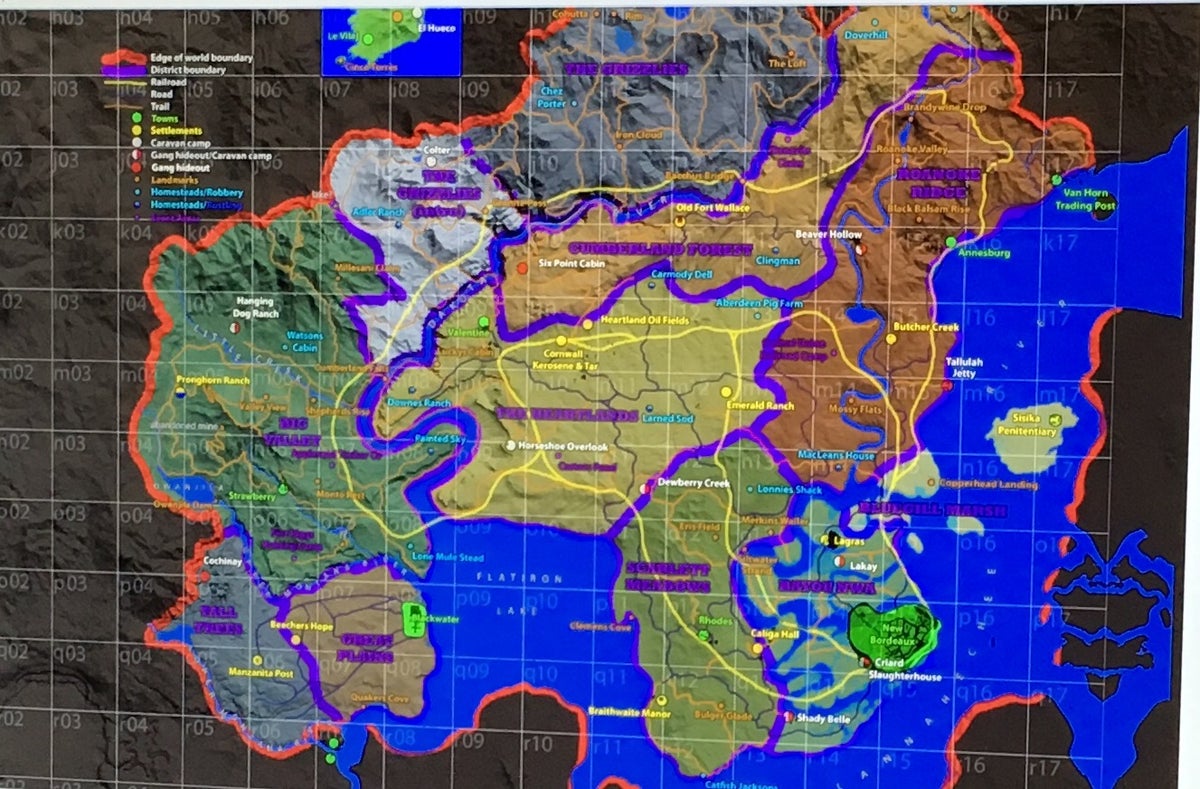

Red Dead Redemption 2: Map for 'prequel' reportedly leaks, The Independent22 dezembro 2024

Red Dead Redemption 2: Map for 'prequel' reportedly leaks, The Independent22 dezembro 2024 -

T-shirt Shading Roblox Corporation, T-shirt, template, angle, text png22 dezembro 2024

T-shirt Shading Roblox Corporation, T-shirt, template, angle, text png22 dezembro 2024 -

Boku no Kokoro no Yabai Yatsu Vol.9 Ch.114 Page 12 - Mangago22 dezembro 2024

Boku no Kokoro no Yabai Yatsu Vol.9 Ch.114 Page 12 - Mangago22 dezembro 2024 -

The song behind one of the most enduring internet memes turns 30 - ABC News22 dezembro 2024

-

Did a bug in Deep Blue lead to Kasparov's defeat? - CNET22 dezembro 2024

Did a bug in Deep Blue lead to Kasparov's defeat? - CNET22 dezembro 2024