Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Last updated 22 dezembro 2024

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

How Taxes Work: Taxes & Social Security Numbers: Visas

Taxes for Mexicans Working in US, TFX

What are FICA Taxes? Social Security & Medicare Taxes Explained

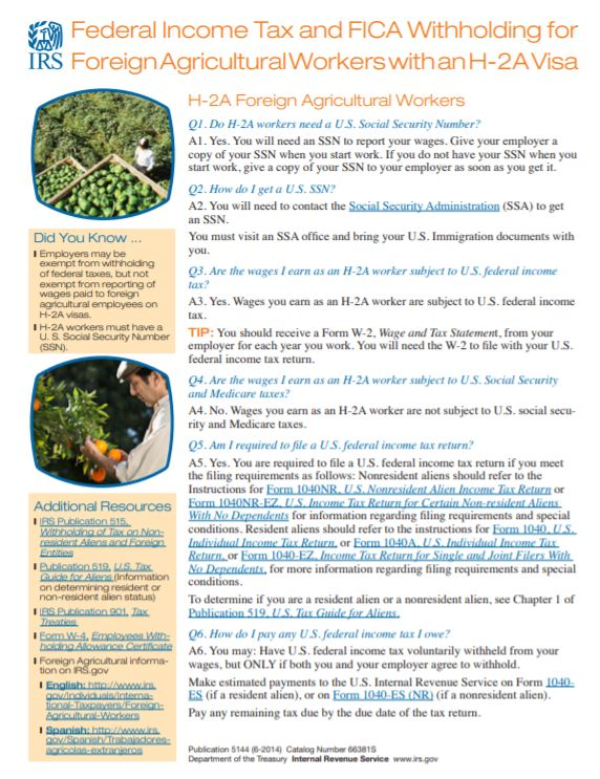

Federal Income Tax and FICA Withholding for Foreign Agricultural

2023 FICA Tax Limits and Rates (How it Affects You)

Resident vs nonresident frequently asked questions

Income Taxes and FICA Withholding Exemption(s) for Foreign Workers

FICA Tax Exemption for Nonresident Aliens Explained

Form 1040 & Non-Resident US Expat Tax, Taxes for Expats

FICA Tax Exemption for Nonresident Aliens Explained

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog22 dezembro 2024

-

What is Fica Tax?, What is Fica on My Paycheck22 dezembro 2024

What is Fica Tax?, What is Fica on My Paycheck22 dezembro 2024 -

What is FICA Tax? - Optima Tax Relief22 dezembro 2024

What is FICA Tax? - Optima Tax Relief22 dezembro 2024 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software22 dezembro 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software22 dezembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know22 dezembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know22 dezembro 2024 -

How An S Corporation Reduces FICA Self-Employment Taxes22 dezembro 2024

How An S Corporation Reduces FICA Self-Employment Taxes22 dezembro 2024 -

What Is FICA Tax?22 dezembro 2024

What Is FICA Tax?22 dezembro 2024 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books22 dezembro 2024

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books22 dezembro 2024 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons22 dezembro 2024

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons22 dezembro 2024 -

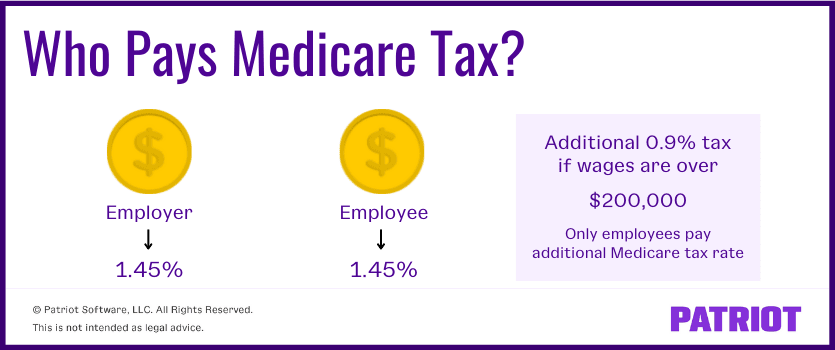

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax22 dezembro 2024

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax22 dezembro 2024

você pode gostar

-

Segunda temporada de One Punch Man chega na Netflix ainda neste mês22 dezembro 2024

Segunda temporada de One Punch Man chega na Netflix ainda neste mês22 dezembro 2024 -

Plants vs. Zombies™ Garden Warfare 2 No-Brainerz Upgrade Price22 dezembro 2024

-

Mochila Bolsa Cavalera Escolar Faculdade Trabalho Notebook Reforçada Espaçosa Moderna - Bolsas e Mochilas para Notebook - Magazine Luiza22 dezembro 2024

Mochila Bolsa Cavalera Escolar Faculdade Trabalho Notebook Reforçada Espaçosa Moderna - Bolsas e Mochilas para Notebook - Magazine Luiza22 dezembro 2024 -

Xadrez, uno e truco: 9 jogos clássicos para se divertir online com22 dezembro 2024

Xadrez, uno e truco: 9 jogos clássicos para se divertir online com22 dezembro 2024 -

Conjunto com 2 BeyBlade Burst QuadStrike - Ambush Achilles A8 Vs22 dezembro 2024

Conjunto com 2 BeyBlade Burst QuadStrike - Ambush Achilles A8 Vs22 dezembro 2024 -

Battleship Board Game Wood Game Laser Cut Game Laser Cut22 dezembro 2024

Battleship Board Game Wood Game Laser Cut Game Laser Cut22 dezembro 2024 -

Mortal Kombat 1: Baraka by Fatal-Terry on DeviantArt22 dezembro 2024

Mortal Kombat 1: Baraka by Fatal-Terry on DeviantArt22 dezembro 2024 -

Phantom Forces Esp Script Pastebin22 dezembro 2024

-

Official Blizzard Gear Merch Hearthstone Showdown in the Badlands T-Shirt - Hnatee22 dezembro 2024

Official Blizzard Gear Merch Hearthstone Showdown in the Badlands T-Shirt - Hnatee22 dezembro 2024 -

![Dump Nintendo Switch Games and Play them on The Computer [Yuzu or Ryujinx] Tutorial [2023]](https://i.ytimg.com/vi/mPiIBQndBR0/hq720.jpg?sqp=-oaymwEhCK4FEIIDSFryq4qpAxMIARUAAAAAGAElAADIQj0AgKJD&rs=AOn4CLBoleEihObfcskJXYvzBOs2zi5_OQ) Dump Nintendo Switch Games and Play them on The Computer [Yuzu or Ryujinx] Tutorial [2023]22 dezembro 2024

Dump Nintendo Switch Games and Play them on The Computer [Yuzu or Ryujinx] Tutorial [2023]22 dezembro 2024